“An audit can either be your strongest shield or your biggest headache.”

As the financial year closes, businesses must prepare for audits to stay compliant with Indian tax laws and avoid last-minute chaos.

Whether you run a startup, SME, or established company, this 2025 audit checklist will help you stay ahead of deadlines, avoid penalties, and pass audits stress-free.

Why Audits Matter

Audits aren’t just a legal formality — they’re a health check-up for your business finances.

- Identify errors before the tax department does.

- Build trust with investors, banks, and stakeholders.

- Ensure compliance with Income Tax Act, GST Act, and Companies Act.

- Avoid penalties under Sections 44AB, 271B, and other provisions.

“Think of an audit like a health exam — skip it, and you risk a financial heart attack later.”

Types of Audits in India

- Statutory Audit

- Mandatory for all companies under Companies Act, 2013.

- Conducted by a Chartered Accountant (CA).

- Tax Audit – Section 44AB, Income Tax Act

- Required if:

- Business turnover > ₹1 crore.

- Professional receipts > ₹50 lakhs.

- Required if:

- GST Audit

- For businesses with annual turnover above the prescribed GST threshold.

- Internal Audit

- Recommended for process checks and internal control review.

- Special Audits

- Directed by tax authorities in case of suspicious activities or disputes.

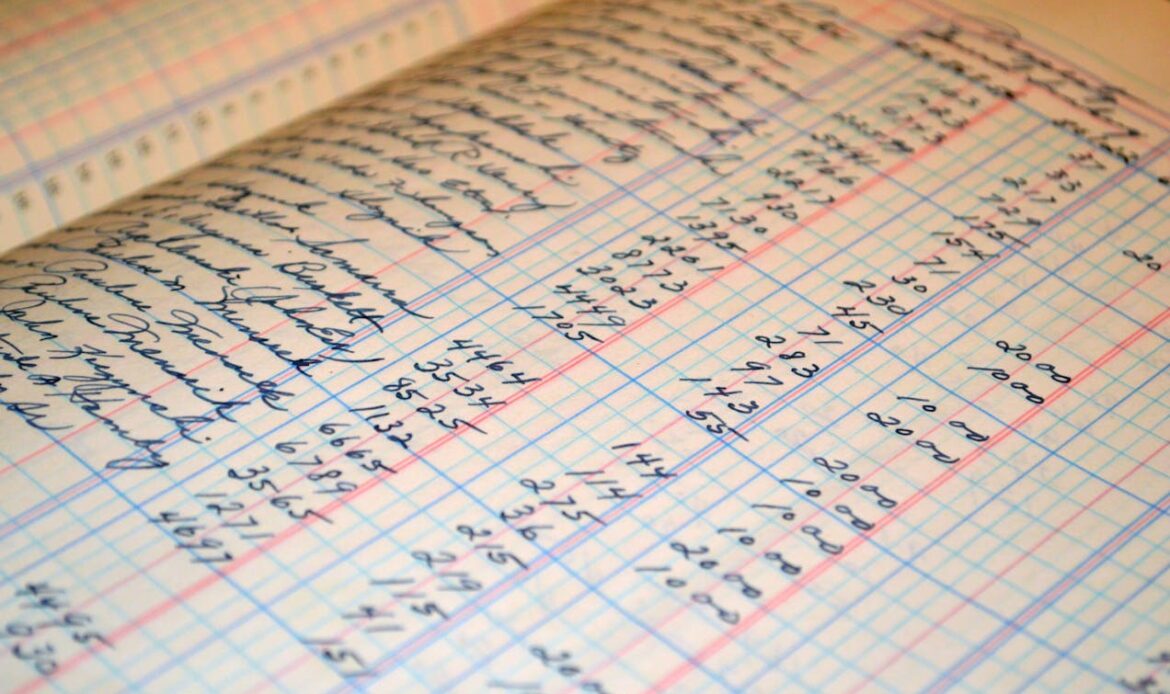

Pre-Audit Preparation – Start Early, Save Stress

“Audits are won before the auditor even arrives.”

Here’s what you should do at the start of the financial year-end:

- Finalize all accounts and ledgers.

- Reconcile bank statements and cash books.

- Verify compliance with GST, TDS, and PF/ESI filings.

- Organize invoices and payment proofs.

- Check opening balances against last year’s audit report.

Audit Checklist – Step-by-Step Guide

- Financial Statements

Prepare and finalize:

- Balance Sheet

- Profit & Loss Account

- Trial Balance

- Cash Flow Statement

Pro Tip:

Cross-check figures with supporting schedules before finalizing.

- Bank Reconciliation

- Match books of accounts with bank statements.

- Resolve any discrepancies immediately.

- Keep signed reconciliation statements ready.

“Mismatched bank records are like red flags waving at auditors — fix them before they do.”

- GST Compliance

- Verify all GSTR-1, GSTR-3B, and GSTR-9 filings are complete.

- Match outward supplies with turnover in books.

- Reconcile ITC with GSTR-2B.

- Clear any pending liabilities or mismatches.

- TDS and Payroll Compliance

- Ensure TDS is deducted and deposited within due dates.

- File TDS returns (Form 24Q/26Q) correctly.

- Verify:

- PF, ESI, and professional tax payments.

- Payroll records match employee salary slips.

- Fixed Asset Register

- Update additions and disposals of assets.

- Apply correct depreciation as per Income Tax Act.

- Verify physical existence of major assets.

- Loan and Liability Verification

- Match loan balances with bank confirmations.

- Verify interest calculations and repayment schedules.

- Inventory and Stock

- Conduct physical stock verification.

- Compare results with accounting records.

- Investigate differences immediately.

- Legal and Regulatory Filings

- ROC filings completed on MCA portal.

- Annual returns filed for LLPs and companies.

- Verify board meeting resolutions and minutes.

- Tax Audit Documents (Section 44AB)

- Computation of total income.

- Tax audit report preparation in Form 3CA/3CB and 3CD.

- Digital signature readiness for final submission.

Example: Tax Audit Applicability

Scenario:

A consulting firm earned ₹65,00,000 in FY 2024-25.

- Since professional receipts exceed ₹50,00,000, Section 44AB tax audit is mandatory.

- The CA will certify the audit in Form 3CB-3CD before filing ITR.

Deadlines for FY 2024-25 (AY 2025-26)

| Filing Type | Due Date |

|---|---|

| Tax Audit Report (Form 3CB-3CD) | 30th September 2025 |

| ITR for audited entities | 31st October 2025 |

| GST Annual Return (GSTR-9) | 31st December 2025 |

| ROC Annual Filing | 30th November 2025 |

“Miss these dates, and you’ll pay in penalties instead of profits!”

Common Audit Mistakes to Avoid

- Mixing personal and business expenses.

- Ignoring reconciliation mismatches.

- Missing TDS or GST payments.

- Filing incomplete or inaccurate returns.

- Last-minute rush to gather documents.

Pro Tips for a Smooth Audit

- Use accounting software for error-free reporting.

- Keep digital backups of all records.

- Schedule a pre-audit review meeting with your CA.

- Prepare a compliance calendar for the next financial year.

Conclusion

Audits don’t have to be stressful.

By preparing throughout the year, maintaining accurate records, and following this checklist, your business can sail through audits confidently.

“A smooth audit isn’t luck — it’s preparation meeting compliance.”

Call to Action

Start preparing now instead of scrambling at the last minute.

Regular reviews and early planning will save you time, money, and stress during audits.

Disclaimer

This article is authored by Anshul Goyal, Chartered Accountant (ICAI India).

It is for educational purposes only and does not replace professional tax or legal advice.

FAQs – Audit Checklist (2025)

Q1. When is a tax audit mandatory?

If business turnover exceeds ₹1 crore or professional receipts exceed ₹50 lakhs under Section 44AB.

Q2. Who can conduct a tax audit?

Only a Chartered Accountant licensed by ICAI.

Q3. Which forms are used for tax audit reporting?

Form 3CA, 3CB, and 3CD.

Q4. Is a GST audit still required in 2025?

Yes, if turnover exceeds the GST audit threshold notified for the year.

Q5. What happens if I miss the audit deadline?

Penalties under Section 271B will apply, plus delayed ITR penalties.