Section 80C of the Income Tax Act, 1961 is the most commonly used tax-saving section by individual taxpayers in India. It allows deductions up to ₹1.5..

Section 80C of the Income Tax Act, 1961 is the most commonly used tax-saving section by individual taxpayers in India. It allows deductions up to ₹1.5..

The Goods and Services Tax (GST) in India is a destination-based indirect tax applicable on the supply of goods and services. But who exactly is responsible..

If your business engages in transactions with foreign affiliates or related domestic entities, Transfer Pricing (TP) compliance is a legal necessity. India’s TP regulations aim to ensure..

Start-ups raising funding in India have long worried about angel tax—the tax under Section 56(2)(viib) when share issue prices exceed fair market value (FMV). Recognizing the..

If you are selling products or services through e-commerce marketplaces like Amazon, Flipkart, Myntra, UrbanClap, or Zomato, you are subject to TDS under Section 194-O of..

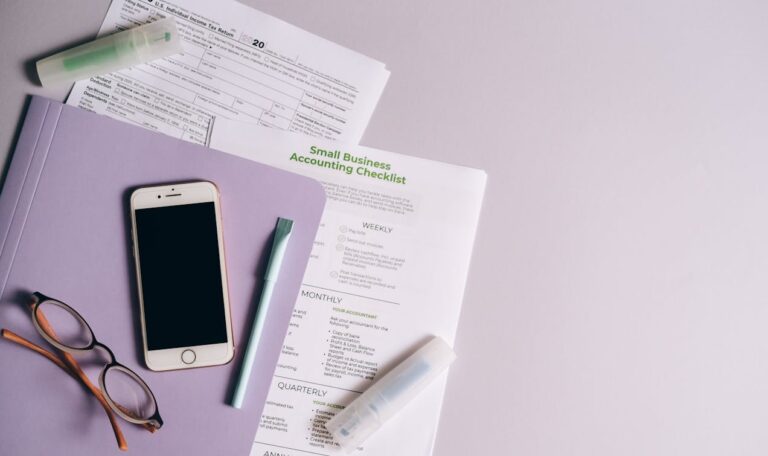

For small businesses, freelancers, and professionals in India, the presumptive taxation schemes under Section 44AD and Section 44ADA provide a simple, low-compliance way to file taxes..

Equalisation Levy 2.0 on Digital Ads As Indian AI firms, SaaS companies, and e-commerce players increasingly depend on global digital platforms for advertising and marketing, Equalisation Levy..

As we enter FY 2025–26, one of the most common triggers for GST notices is the mismatch between GSTR-3B (summary return) and GSTR-1 (outward supply return)…

In today’s fast-moving SaaS ecosystem, founders often focus on scaling users and ARR (Annual Recurring Revenue), but investors now look just as hard at tax and compliance..

India’s corporate tax regime has undergone major reforms in the past few years. Among them, Section 115BAA offered domestic companies a lower tax rate with no exemptions—a..